Frequently

Asked

Questions

You’ve got questions

And we love answering your questions!

WE’ve gathered a few of our most common questions right here for you.

We know taxes can be scary, confusing, and frustrating. We also know many people just don’t want to deal with them anymore. Whether you’ve stumbled across this page or you’ve been sent here, we look forward to getting you the answers you need.

If your question isn’t answered to the right or by scrolling down to a deeper dive, we encourage you to send your question our way sooner rather than later. The sooner we know what you need, the sooner we can provide a solution.

Where and how do we start working together?

The first step to working with us is completing an introductory survey. Your survey is the first step in determining if we might be a good fit to work together. If we are, we’ll have a virtual meet and greet to dig into a little bit more detail. The survey and this discovery meeting will give me information about you, let me tell you about Crayon Advisory and how we can support you, and outline the Onboarding Process.

What do you need to get started on my tax return?

If you’re a returning client, or a new client who has done the above, we will need the following from you prior to getting started on your tax return:

- Signed Engagement Letter

- Paid Deposit (payable with the engagement letter once all parties have signed)

- Completed Organizer

- Your initial documents provided through Acounta

Details on all of this are provided with your engagement letter delivery. For new clients, this usually gets to you about two weeks after you approve your quote. There are some steps that have to happen before this, and how long all of that takes in in part dependent on you.

When will I get my Engagement Letter?

As with most things, that depends!

If you are an individual, I will need you to complete the Auxiliary Software Consent prior to preparing your engagement package.

Engagement letters for returning clients go out as soon as all systems are set as a go, with any updated processes supported with details and how-tos sent directly to clients. We aim to push these out no later than January of the tax season. New clients onboarding during the year generally receive their first engagement letter about two weeks after quote approval. This is dependent on how and when we’re starting to work together.

How much does this cost?

Just as before, it really depends.

In May of 2024, pricing starting points include, but are not limited to:

- for individuals who are employed and do not have a business or significant investment activity start at $750;

- for business owners starts at $1,200;

- for indivdiuals with significant investments (including ESPP, ESOP, ISO, and other equity plans) starts at $900;

- tax planning, projections, and other advisory services are dependent on your specific needs and can range from $150+/month for recurring advisory services to $450+ for projections. The advisory services we offer to you will vary depending upon your situation;

- S-corporation exploration starts at $1,997

- Accounting System Set up and support starts at $1,697

What are these Auxiliary Software Consents I keep seeing?

Informed consent is important. Beginning in December of 2021, we started asking our clients to complete an Auxiliary Software Consent. This consent outlines the software we use in providing services to you.

You do not have to grant consent for us to use each piece of software. Choosing not to grant the use of a specific piece of software may incur additional fees.

The sooner we have compelted consents from you (and your spouse or partner if filing a married joint tax return), the sooner we will be able to prepare your engagement letter.

What comes with my engagement package?

Your engagement package will be delivered through a series of emails and notifications:

- An email directly from me telling you your Engagement Letter and other information is on the way (it might even be ready for you when you hop into Acounta!).

- Action Items inside your Acounta Portal tailored to you. These include, but are not limted to, your Engagement Letter, certain Questionnaires, and File Requests.

- Three days later, you’ll begin recieving a series of automated emails reminding you to go through all of your action items before we can get started on your tax return.

Where can I find my Organizer? What about Questionnaires? And what's the difference?

Your Action Items in Acounta will include certain questionnaires we need you to complete. If you or your spouse own a business, the business owner will need to be the one to complete the related questionnaire.

Most of these are standardized. However, some of these questionnaires may be partially or even completely customized to you and your tax situation.

In the past, we’ve been like other preparers and called these, “Organizers.” With the 2024 tax season, we started calling these, “Questionnaires,” to better reflect both how they show up for you and what they’re doing.

Can I just send you my information over email?

Short answer: No.

Email is a great tool to reach out, ask a question, or otherwise start a conversation. That moment when you think you need help but you’re not sure? Or when you know you need help? Email is a great place to just put a bit of word vomit down and move the needle forward.

As wonderful as email is, it’s not secure, and should not be used for transmitting anything with something you’d want handled with discretion.

Crayon Advisory, LLC uses two tools to transmit information securely:

- Acounta is our secure client portal. You can upload files directly or use the internal messages tool (also called email inside Acounta; I know, it’s confusing) to send us a secure message with an attachment.

- Cognito Forms is a form software tool that may ask for certain information that may be senstive or secret.

Our email automatically removes attachments at the server for your and every other client’s protection. If you receive a notice, you’ll need to upload it to Acounta, preferrably as a PDF.

You’ve got questions

And we love answering your questions!

WE’ve gathered a few of our most common questions right here for you.

We know taxes can be scary, confusing, and frustrating. We also know many people just don’t want to deal with them anymore. Whether you’ve stumbled across this page or you’ve been sent here, we look forward to getting you the support you need.

If your question isn’t answered to the right or by scrolling down to a deeper dive, we encourage you to send your question our way sooner rather than later. The sooner we know what you need, the sooner we can provide a solution.

Where and how do we start working together?

The first step to working with us is completing an introductory survey. Your survey is the first step in determining if we might be a good fit to work together. If we are, we’ll have a virtual meet and greet to dig into a little bit more detail. The survey and this discovery meeting will give me information about you, let me tell you about Crayon Advisory and how we can support you, and outline the Onboarding Process.

What do you need to get started on my tax return?

That depends! If you’re a new client and we haven’t already spoken, you’ll need to start by completing your Introductory Survey. We’ll go over next steps and details once this is complete.

If you’re a returning client, or a new client who has done the above, we will need the following from you prior to getting started on your tax return:

- Signed Engagement Letter

- Paid Deposit (payable with the engagement letter once all parties have signed)

- Completed Organizer

- Your initial documents provided through Acounta

Details on all of this are provided with your engagement letter delivery. For new clients, this usually gets to you about two weeks after you approve your quote. There are some steps that have to happen before this, and how long all of that takes in in part dependent on you.

When will I get my Engagement Letter?

As with most things, that depends!

If you are an individual, I will need you to complete the Auxiliary Software Consent prior to preparing your engagement package.

Engagement letters for returning clients go out as soon as all systems are set as a go, with any updated processes supported with details and how-tos sent directly to clients. We aim to push these out no later than January of the tax season. New clients onboarding during the year generally receive their first engagement letter about two weeks after quote approval. This is dependent on how and when we’re starting to work together.

How much does this cost?

Just as before, it really depends.

In May of 2024, pricing starting points include, but are not limited to:

- for individuals who are employed and do not have a business or significant investment activity start at $750;

- for business owners starts at $1,200;

- for indivdiuals with significant investments (including ESPP, ESOP, ISO, and other equity plans) starts at $900;

- tax planning, projections, and other advisory services are dependent on your specific needs and can range from $150+/month for recurring advisory services to $450+ for projections. The advisory services we offer to you will vary depending upon your situation;

- S-corporation exploration starts at $1,997

- Accounting System Set up and support starts at $1,697

What are these Auxiliary Software Consents I keep seeing?

Informed consent is important. Beginning in December of 2021, we started asking our clients to complete an Auxiliary Software Consent. This consent outlines the software we use in providing services to you.

You do not have to grant consent for us to use each piece of software. Choosing not to grant the use of a specific piece of software may incur additional fees.

The sooner we have compelted consents from you (and your spouse or partner if filing a married joint tax return), the sooner we will be able to prepare your engagement letter.

What comes with my engagement package?

Your engagement package will be delivered through a series of emails and notifications:

- An email directly from me telling you your Engagement Letter and other information is on the way (it might even be ready for you when you hop into Acounta!).

- Action Items inside your Acounta Portal tailored to you. These include, but are not limted to, your Engagement Letter, certain Questionnaires, and File Requests.

- Three days later, you’ll begin recieving a series of automated emails reminding you to go through all of your action items before we can get started on your tax return.

Where can I find my Organizer? What about Questionnaires? And what's the difference?

Your Action Items in Acounta will include certain questionnaires we need you to complete. If you or your spouse own a business, the business owner will need to be the one to complete the related questionnaire.

Most of these are standardized. However, some of these questionnaires may be partially or even completely customized to you and your tax situation.

In the past, we’ve been like other preparers and called these, “Organizers.” With the 2024 tax season, we started calling these, “Questionnaires,” to better reflect both how they show up for you and what they’re doing.

Can I just send you my information over email?

Short answer: No.

Email is a great tool to reach out, ask a question, or otherwise start a conversation. That moment when you think you need help but you’re not sure? Or when you know you need help? Email is a great place to just put a bit of word vomit down and move the needle forward.

As wonderful as email is, it’s not secure, and should not be used for transmitting anything with something you’d want handled with discretion.

Crayon Advisory, LLC uses two tools to transmit information securely:

- Acounta is our secure client portal. You can upload files directly or use the internal messages tool (also called email inside Acounta; I know, it’s confusing) to send us a secure message with an attachment.

- Cognito Forms is a form software tool that may ask for certain information that may be senstive or secret.

Our email automatically removes attachments at the server for your and every other client’s protection. If you receive a notice, you’ll need to upload it to Acounta, preferrably as a PDF.

Sometimes, you need more details

That’s why we have a Deeper Dive

We’ve started migrating our most read and most helpful articles from our Coda Based Deeper Dive directly to our website, here.

While we transition everything, you’ll see the three most recently published/migrated articles to the right. Scroll below to see everything. And, if you’ve been sent specific links, those are probably the best place for you to start.

As we complete this project, we’ll tidy up the organization and make finding what you might be looking for easier.

Can I Deduct That!?

Your tax deductions are how you reduce your income and are one way to pay less in taxes. But not every deduction applies to everyone. Here, we’ll go through some common Deductions and when they might be applicable to you.

Tax Projections and Planning

Tax planning and projections are most useful, and sometimes absolutely necessary, when something in your life or world brings about a change in your income. Because changes in your income also mean changes in your taxes. Whether you're starting a new and exciting job...

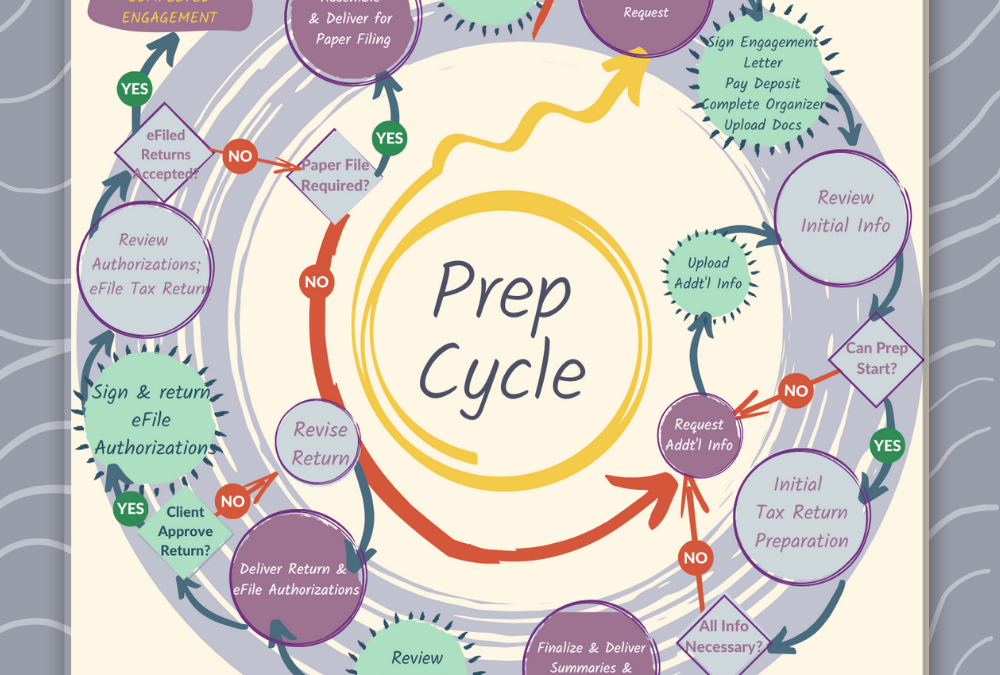

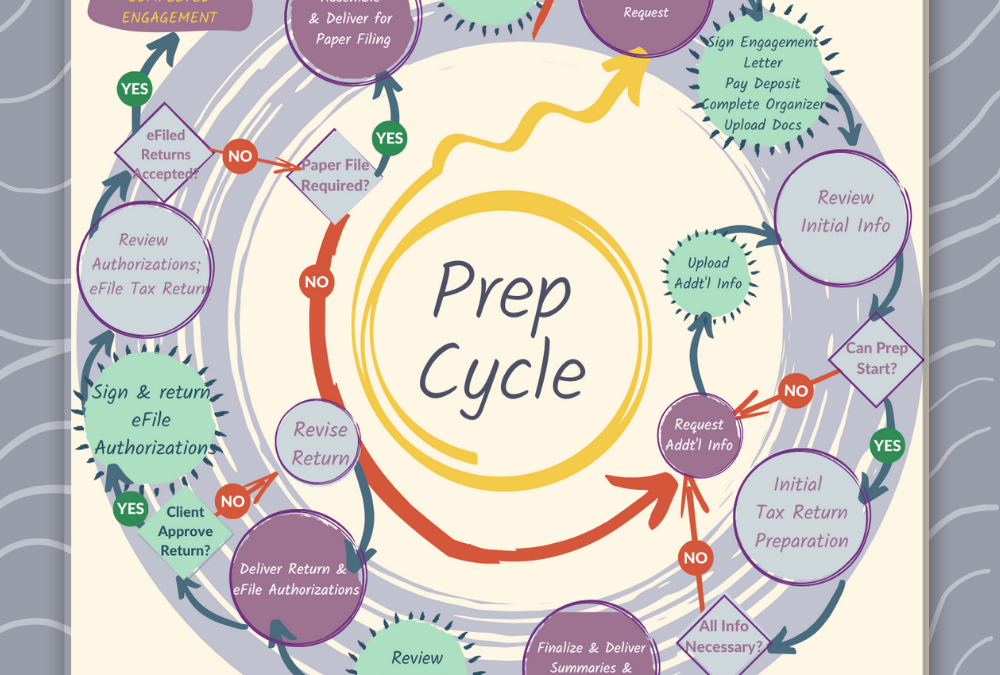

Tax Return Preparation Cycle

Tax Return Preparation is a cyclical dance. We whirl across the floor with you, making sure you know all the steps and are supported in taking them.

Sometimes, you need more details

That’s why we have a Deeper Dive

We’ve started migrating our most read and most helpful articles from our Coda Based Deeper Dive directly to our website, here.

While we transition everything, you’ll see the three most recently published/migrated articles to the right. Scroll below to see everything. And, if you’ve been sent specific links, those are probably the best place for you to start.

As we complete this project, we’ll tidy up the organization and make finding what you might be looking for easier.

Can I Deduct That!?

Your tax deductions are how you reduce your income and are one way to pay less in taxes. But not every deduction applies to everyone. Here, we’ll go through some common Deductions and when they might be applicable to you.

Tax Projections and Planning

Tax planning and projections are most useful, and sometimes absolutely necessary, when something in your life or world brings about a change in your income. Because changes in your income also mean changes in your taxes. Whether you're starting a new and exciting job...

Tax Return Preparation Cycle

Tax Return Preparation is a cyclical dance. We whirl across the floor with you, making sure you know all the steps and are supported in taking them.