Starting a Business

Starting a business is exhilarating.

Let’s take away some of the overwhelm that comes with starting a business, shall we?

1. Determine legal structure & file necessary paperwork.

Startin a business starts with knowing how you and your business exist in the world. Are you a sole proprietor? Will you file an Assumed Business Name? Does registering an LLC make sense for you and your business? What about a corporate status?

There are many options to choose from and it’s imperative to choose the right option for your situation. This step is definitely worth consulting both an attorney and a tax professional (yes, that can be us). Please don’t take advice from social media or your mom’s neighbor’s Uncle Fred (unless of course Fred is a qualified professional). We have referrals to attorneys if and as necessary.

There’s a little bit of chicken and egg happening here – who do you talk to first? Why one over the other? And what’s this going to cost? These are all good questions, and we don’t have the answers in this particular article. The important thing is to start somewhere.

If you’re ready to get started with someone at your side, it’s as good a time as any to introduce yourself to us.

2. Obtain an EIN

Do this directly through the IRS. It’s free. If you land somewhere that’s trying to charge you money to do this, run away, come back to this link and use it.

This step comes after step one because you need the name and business structure when you apply for your EIN. The application process is relatively quick and painless. And you’ll get instant gratification with a letter. Save this letter forever and always.

If you’re a sole proprietor (even if you register an Assumed Business Name) and don’t have employees, you can skip this step.

2(a). If you form a business entity, register with FinCEN

This one’s short and sweet. Head here to learn more details. If you create a business entity (register an LLC or form a Corporation), you’ll need to register that entity with FinCEN within 90 days of creation.

There are rather large fines if you don’t do this.

Starting a business certainly comes with learning to jump through necessary hoops, even if they’re quite dull.

3. Open a business bank account

This isn’t only necessary to protect yourself from certain liabilities if your business is an entity, but it also keeps your accounting records squeaky clean. You can read more about starting your accounting fresh here.

Yes, the business bank account thing matters even if you’re small, just starting out, or any other way you want to minimize your business. There is no just or only or anything else. There’s starting a business.

We have some guidance on selecting your business bank here.

4. Pick Accounting Software to make use of.

Your accounting is the skeleton of your business’s finances, and your accounting software is the backbone.

There are many different accounting system options ranging in pricing and use. You’ll need a way to accurately track the income & expenses associated with your business. Not only do you need these numbers for tax purposes, but are also needed if you want to perform any type of analysis on the performance of your business model. Your accounting system can also be an asset in tracking payments and invoices as well as become a central hub of all things money within your business’s entire systems.

Start here for our recommendations of accounting software and considerations to make for this selection.

Yes, we require all of our business clients to use accounting software. Even if you’re barely starting a business, taking these steps now will make it easier in the future to make sure these tasks are taken care of as your business grows.

5. Setup a State Employer Account

6. Pick a payroll platform.

Just like with Accounting Software, there’s many options out there (Gusto, OnPay, ADP, Paychex, and more) to support this need. Using a payroll platform will save you a lot of time and headache to get on a platform that allows you to electronically pay your employees and send in required payroll reports to the government.

We don’t process payroll. You will need to select a payroll processor if you plan on or need to run payroll.

While many payroll systems will also provide you with the ability to do more than run payroll and perform related tasks, including but not limited to pay reimbursements, pay contractors, and prepare 1099s in January, these actions are not the same thing as payroll. Independent contractors are not employees or 1099 employees. They are contractors.

Remember: these are only the first, small steps to take.

Do you want extra bonus credit?

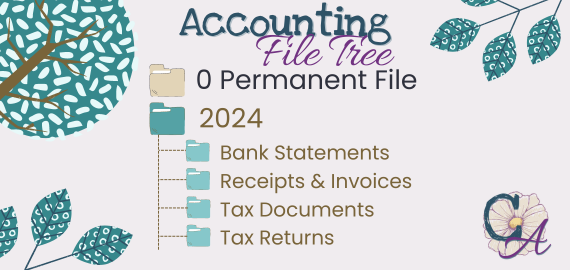

You’re starting your business, you might as well start a quality file saving habit and a robust File Tree for tax and accounting related information.

Saving Files is a Must

Documentation is super important. When it comes to your business, “I think,” often isn’t enough – you need to know. Saving everything, and having a method and rhyme and reason to saving it all is incredibly helpful.

What's a File Tree?

A File Tree is just a way of thinking about the hierarchy within your filing system. While your business will likely need a whole bunch more than this tree I recommend, this is a good starting point for your accounting, bookkeeping, taxes, and related needs.

The Permanent File

This folder is for things that are, “sticky,” from one year to the next. I encourage labeling it with a leading zero so it jumps to the top of the file tree and stays in a reliable location. Good examples of files that are likely to land here include:

- EIN Letter from the IRS

- Certain permanant tax elections made directly and not with the tax return

- Accounting Policies

- Amortization Schedules that cover more than one year

These files should exist in your Accounting Permanant File even if they also exist elsewhere. These files are directly related to accounting and tax, and so should be in easy reach of other files related to accounting and tax.

A few more things that find their way here

There are some other, related files that may find their way here. Especially if they do, the Accounting Folder might be more of an Accounting & Business Administration Folder.

- Operating Agreement or Bylaws as appropriate

- Entity Formation Documents

Does this have to be complicated?

No.

In fact, in many ways simplicity is best. Simple is often easier to follow, and thus easier to do.

The Accounting Branch

This grouping of folders will likely need to sit in one folder level higher labeled for Accounting.

Annual Files (2024)

These annual files are intended to gather information that repeats itself annually. You might label yours as, “2024 Accounting & Tax,” or similar. The folders we recommend you have are highlighted below along with the reasoning for the specific folder.

Bank Statements

This may also include credit card statements. Any bank account or credit card you use for business should have its statements saved here on a regular basis. Not only will you need this for monthly bank account reconciliations, but, you’ll also need this as part of your documentation for your tax return. We usually only ask for the December bank statements for tax return preparation, however, as a business owner you have a requirement to keep certain documentation, which will include bank statements. We provide all of our clients guidelines for documentation retention at tax return completion.

Saving your bank statements means regularly means you have a copy and its in your control, regardless of what the bank does or policies the bank has.

Receipts & Invoices

The IRS has some pretty strict guidelines on receipts and invoices to save. It’s so easy to do now, I encourage having a folder for this and either printing receipts & invoices you receive to pdf to save in this folder or grabbing a scan of it on your phone when you receive the receipts.

Hot tip: When saving the file, label it, “01 January,” or whatever month to have your filing system enforce some amount of order.

Tax Documents

This doesn’t usually start filling up until January of the following year. Depending on your business and business entity type, you might not have anything to put in here. Forms you receive, especially Forms 1099 of any flavor, should live here.

Tax Returns

This is a place for your copy of your tax returns to live. At tax return completion, we provide you with a complete copy of your return, payment vouchers if/as appropriate, and letters and summaries to support you. All of this can go here so you can easily find it.

This post has been developed as a generic explanation of minimum steps to take when starting a business. This is incredibly brief article on a very deep and wide topic. This information is written to be informative and is not tax advice. You should consult with your tax advisor as to how this information applies to your situation. Your specific needs may vary and may cause specific attention to need to be given to your processes. You should speak with your tax professional regarding the applicability of these issues to you and your business (and, yes, that includes Crayon Advisory if you are a current or onboarding client).