Let’s get to work

Processes, Communications, Policies

Let’s get to work

Processes, Links, and Resources

We’re heavily process driven, perhaps to a fault. We’ve included a few details about several of our processes and policies here.

Communication

We rely on email as our primary form of communication. Starting in the fall of 2025, we’re also moving into Acounta as our secure client portal.

We encourage your tax and accounting questions! Please send them to us. We cannot answer your questions if we don’t know what they are.

Questions about updates are rarely answered. We’ll provide you with an update as soon as we have one. Our Prioritized, First In, First Out ordering is available here.

Engagement Letters

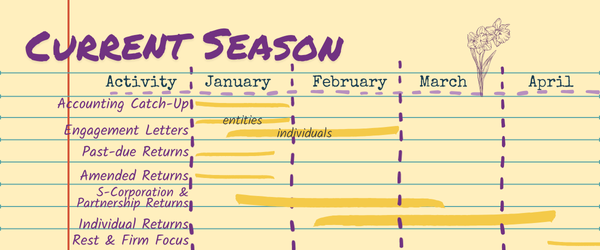

Engagement letters define and outline the terms of the engagement between you and Crayon Advisory, LLC. They’re the first step in any engagement process. We stagger tax return Engagement Letter delivery based on tax return due dates and your habits and preferences.

Organizers & Questionnaires

We provide you with organizers and questionnaires in your portal as relevant to the engagement and your personal situation.

Most of our information gathering is either asking for a document or file, providing you with a questionnaire directly inside our portal, or providing you with a fillable PDF you can use to provide information.

These organizers and questionnaires are an important part of your tax return preparation process – they help us know and understand what happened and what more information we might need to ask about.

Secure Client Portal

In the fall of 2025, we’re migrating to Acounta for our secure client portal. If you’re a current/returning clients, you can still access Moxo. New clients are onboarded into Acounta. Returning clients will be onboarded into Acounta in the last half of October and into the first part of November.

We have a brief introduction to Acounta here. This is intended for clients new to Crayon Advisory, LLC.

Regardless of which client portal we’ve used, it’s always been an integral part of the process at Crayon Advisory – giving us both a single place to provide necessary information.

Billing & Pricing

Our and payment schedule are provided to you at the start of every engaement.

Tax Returns

- 40% of the quoted cost to you to begin tax return preparation

- Remaining 60% due prior to providing you with a copy of your completed tax return. This second payment may change based on the final cost of your tax return.

Tax Projections, Planning, and One-Time Advisory

100% of the quoted cost is due at the start of the engagement. Any additional fees for changes in scope will be billed at completion and are payble prior to final delivery.

Recurring Advisory

100% of the cost of your recurring advisory services are due at the start of the term. That may be monthly and it may be quarterly.

Service fee Philosophy

We use a flat fee, vlaue-based fee schedule. Fees for services provided to you are quted at the start of a project based on information we have at the time. We communicate any changes to you in writing along the way. Wherever possible, we will provide you with options to reduce any fees.

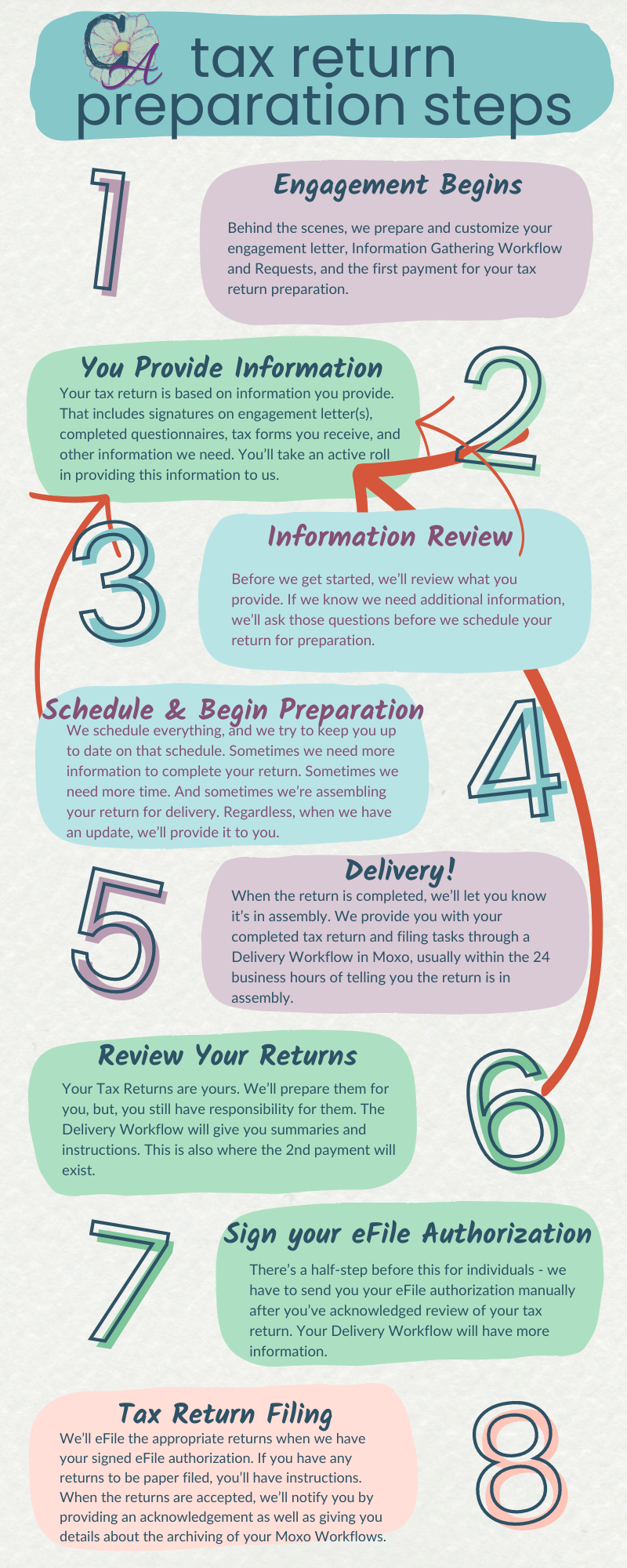

We’ve developed a system and process to help support you and your tax return preparation needs. That process starts with defining your engagement and gathering information necessary.

Initial Information

Between the middle of December and the end of January, you will receive a welcome or welcome back packet that will help you gather the information necessary for your tax return.

Tax Return Preparation Timing & Updates

Preparation and Delivery of your tax return is dependent on many factors. We’re making use of automated emails to update you on the status and stage of your tax return, provide approximate delivery windows, and remind you of information or next steps you need to take.

Secure Client Portal

Our portal is powered by Acounta. This Dahboard based platform allows for easy long-term storage of your tax returns and for us to request specific information from you. You can jump straight into your portal here or get an introduction to Acounta here.

Let’s get your Taxes Done

Businesses

Let’s get your taxes done

Businesses

Your business runs with processes, and tax return preparation is just one more to tack on. We have our own processes and rules we have to follow when preparing your tax return.

Initial Information

We’ll start requesting initial information from entities starting as soon as the middle of December. You’ll receive emails and notifications in your portal space with details.

Tax Return Preparation Timing & Updates

Preparation and Delivery of your tax return is dependent on many factors. We’re making use of automated emails to update you on the status and stage of your tax return, provide approximate delivery windows, and remind you of information or next steps you need to take.

Consent to Disclosure

If you’re working with another professional and would like me to communicate with them about your taxes, I need you to fill this out. Yes, I need a new one for each professional you need/want me to collaborate with.

Secure Client Portal

Our portal is powered by Acounta. This Dahboard based platform allows for easy long-term storage of your tax returns and for us to request specific information from you. You can jump straight into your portal here or get an introduction to Acounta here.

Accounting Software Access

Business tax return preparation starts with the accounting. Usually, by the time we’re working on the tax return, we’ve had access to your accounting software for a minute. If this changes or we need access, we’ll be sure to ask for it as part of tax return preparation.

Accounting software isn’t one size fits all. We help you find the right fit for you and your business, both now and in the future. Check out our recommendations below, and reach out to schedule an appointment to discuss further.

Freshbooks

FreshBooks – https://freshbooks.com – is pretty. It can be a little easier to look at because there is no white space – it’s very neurodivergent friendly. The software is a bit more prescriptive in its approach to doing the accounting. This can be a good thing, as you’re essentially forced to do things correctly. In the past, I sat on the FreshBooks Advisory Council.

Xero

Xero – https://xero.com – is minimalist in its design approach. This software starts at $11/month and includes a receipt manager with it called HubDoc. The software has many bells and whistles that can be overwhelming. The bells and whistles aren’t shoved in front of your face and are pretty easy to ignore. This is a software I can set up for you, and then you get emails to get into it.

Wave

Wave – https://waveapps.com – can be free. Yes, can be completely free to use. It is a little clunkier, but is fully functional. It has almost no bells and whistles. Businesses who have no need of third party app integrations, project management, or significant automation procedures end up doing just fine inside this software. The price is right though, and you may be able to grow from Wave to something more robust over time. There is a risk to doing this in that you may not be able to bring in historical data to your new software easily. This isn’t always a problem, and solutions can always be discussed at the time of change.