Tax

Season

2025 FAQ

We know tax season is stressful.

But it doesn't have to be. Let's make Tax Season 2025 the best ever. We'll start with this FAQ. It's for you as a resource and a reminder - there's much to do, much to remember, and no one can possibly do all that without a little bit of help.

We know tax season is stressful.

But it doesn't have to be. Let's make Tax Season 2025 the best ever. We'll start with this FAQ. It's for you as a resource and a reminder - there's much to do, much to remember, and no one can possibly do all that without a little bit of help.

%

Entity Tax Prep Workspaces Released

The next entity returns we’re working on contain Feb 12, 2025 and in their queue number. Entities will receive preparation priority for returns with complete information received before February 17, 2025. Please check Moxo and/or your email for a notification regarding the status of your tax return that will include a queue number.

Entities include Partnerships (form 1065), S-Corporations (from 1120-S), C-Corporations (form 1120), and Trusts (form 1041). Trusts receive a priority more similar to indiviudals in the spring and more similar to entities in the fall.

Moxo released several new updates this year that are half-way to brilliant. The first version of these updates was relased at the end of November of 2024.

The second version was released on February 6th, 2025.

We’ve had to learn about these new releases, adapt, and build the templates you’ve come to know and trust to ensure they’re giving you the best experience possible. While this has slowed us down, that slowdown is allowing us to focus on reacting to unexpected challenges and ensure a better experience as we roll out more workspaces.

This is going to get techy. If you’re not a techy person, please stop reading here and know and understand we’re working behind the scenes to balance effective use of technology, requesting information from you, and getting work done. The biggest changes Moxo has made are:

- A, “Prepare,” button that allows/forces us to take an action on a specific step before that step is released to you fully. This allows us to ensure we can update or provide support on steps that are more collaborative.

- Decision Points – these are binary decisions and are being used to ask if you would like to have a meeting to go over your initial information, to ask if someone is still a dependent, and other very, “yes/no,” type questions.

- Conditional Branches – these allow us to release steps to you based on how you want to take a particular action. These branches are ensuring you get the reminders you need of things to do and actions to take.

There’s a logic issue in how Moxo has created the Decision Points and Conditional Branches: they are dependent on Workspace Sequential Order. Any other type of action I can allow the Workspace to, “Skip Sequential Order,” which allows you to continue to work through information as you have in the past and at your convenience. The Decision Points and Conditional Branches cannot skip sequential order. The logic on these has to run one at a time, which means if there’s an action inside a Conditional Branch, all previous actions have to be completed first.

While we understand the design decisions Moxo made behind this (and, if you’ve gotten this far and are keeping up, I’m sure you do, too), we don’t agree with them. We are working with Moxo to help them understand what isn’t working and why. As of February 18th, no updates on this have been provided.

As of February 18th, 2025, we’ve seen minimal direct impact from the current administrations executive decisions in the tax world.

The massive layoffs at the federal government have come the IRS, with all probationary employees being terminated. This has already impacted the IRS’s ability to serve taxpayers as caseload shifts to employees who were not terminated. This is not good news.

On Thursday, February 21st, the White House and Treasury Department agreed to prohibit DOGE from accessing your data at the IRS.

That doesn’t mean everything is business as usual. It’s not.

Federal employees are on a probationary status for a year both when they are hired and when they change titles, positions, departments, and/or are promoted. This now includes IRS employees. If you are questioning this and looking for a source, I encourage you to go to LinkedIn, BlueSky, and/or Threads where now former federal employees are discussing this.

Behind the scenes, Megan is working with the NAEA and the tax preparer community as a whole to mnimize the often devastating impact we’re seeing. This does take from releasing Engagement workspaces and preparing tax returns, which is why Megan is limiting the time spent on these activities.

Megan sees hope where there is community and collaboration. Megan sees hope in the HHS website being restored, even if there is a note about the administration’s beliefs regarding gender that are not based in scientific fact or lived experience. Megan sees hope in the coalitions that are emerging and reemerging.

Engaging in democracy and community are our stronger resources. Call your Senators and Representative. Use the Congressional Switchboard and leave a message with your name and zip code. Pick one or two issues and call every day. Engage with your professional organizations. The more you engage your direct community, the more you can do and the more you may feel like you have control in an uncontrollable situation.

%

Individual Tax Prep Workspaces Released

The next Individual tax returns we’re working on contain Feb 12, 2025 and in their queue number. Entities will receive preparation priority for returns with complete information received before February 17, 2025. Please check Moxo and/or your email for a notification regarding the status of your tax return that will include a queue number.

Individuals file federal Form 1040 and related schedules and forms.

%

Entity Tax Prep Workspaces Released

The next entity returns we’re working on contain Feb 12, 2025 and in their queue number. Entities will receive preparation priority for returns with complete information received before February 17, 2025. Please check Moxo and/or your email for a notification regarding the status of your tax return that will include a queue number.

Entities include Partnerships (form 1065), S-Corporations (from 1120-S), C-Corporations (form 1120), and Trusts (form 1041). Trusts receive a priority more similar to indiviudals in the spring and more similar to entities in the fall.

Moxo released several new updates this year that are half-way to brilliant. The first version of these updates was relased at the end of November of 2024.

The second version was released on February 6th, 2025.

We’ve had to learn about these new releases, adapt, and build the templates you’ve come to know and trust to ensure they’re giving you the best experience possible. While this has slowed us down, that slowdown is allowing us to focus on reacting to unexpected challenges and ensure a better experience as we roll out more workspaces.

This is going to get techy. If you’re not a techy person, please stop reading here and know and understand we’re working behind the scenes to balance effective use of technology, requesting information from you, and getting work done. The biggest changes Moxo has made are:

- A, “Prepare,” button that allows/forces us to take an action on a specific step before that step is released to you fully. This allows us to ensure we can update or provide support on steps that are more collaborative.

- Decision Points – these are binary decisions and are being used to ask if you would like to have a meeting to go over your initial information, to ask if someone is still a dependent, and other very, “yes/no,” type questions.

- Conditional Branches – these allow us to release steps to you based on how you want to take a particular action. These branches are ensuring you get the reminders you need of things to do and actions to take.

There’s a logic issue in how Moxo has created the Decision Points and Conditional Branches: they are dependent on Workspace Sequential Order. Any other type of action I can allow the Workspace to, “Skip Sequential Order,” which allows you to continue to work through information as you have in the past and at your convenience. The Decision Points and Conditional Branches cannot skip sequential order. The logic on these has to run one at a time, which means if there’s an action inside a Conditional Branch, all previous actions have to be completed first.

While we understand the design decisions Moxo made behind this (and, if you’ve gotten this far and are keeping up, I’m sure you do, too), we don’t agree with them. We are working with Moxo to help them understand what isn’t working and why. As of February 18th, no updates on this have been provided.

As of February 18th, 2025, we’ve seen minimal direct impact from the current administrations executive decisions in the tax world.

The massive layoffs at the federal government have come the IRS, with all probationary employees being terminated. This has already impacted the IRS’s ability to serve taxpayers as caseload shifts to employees who were not terminated. This is not good news.

On Thursday, February 21st, the White House and Treasury Department agreed to prohibit DOGE from accessing your data at the IRS.

That doesn’t mean everything is business as usual. It’s not.

Federal employees are on a probationary status for a year both when they are hired and when they change titles, positions, departments, and/or are promoted. This now includes IRS employees. If you are questioning this and looking for a source, I encourage you to go to LinkedIn, BlueSky, and/or Threads where now former federal employees are discussing this.

Behind the scenes, Megan is working with the NAEA and the tax preparer community as a whole to mnimize the often devastating impact we’re seeing. This does take from releasing Engagement workspaces and preparing tax returns, which is why Megan is limiting the time spent on these activities.

Megan sees hope where there is community and collaboration. Megan sees hope in the HHS website being restored, even if there is a note about the administration’s beliefs regarding gender that are not based in scientific fact or lived experience. Megan sees hope in the coalitions that are emerging and reemerging.

Engaging in democracy and community are our stronger resources. Call your Senators and Representative. Use the Congressional Switchboard and leave a message with your name and zip code. Pick one or two issues and call every day. Engage with your professional organizations. The more you engage your direct community, the more you can do and the more you may feel like you have control in an uncontrollable situation.

%

Individual Tax Prep Workspaces Released

The next Individual tax returns we’re working on contain Feb 12, 2025 and in their queue number. Entities will receive preparation priority for returns with complete information received before February 17, 2025. Please check Moxo and/or your email for a notification regarding the status of your tax return that will include a queue number.

Individuals file federal Form 1040 and related schedules and forms.

Tax season 2025 FAQ

We’re just as excited about the 2025 Tax Season as you are.

Besides doing some tax planning and projections, a look-back and reset or two, and even some late filings, we’re spending time behind the scenes to make this coming tax season as smooth and easy as possible.

We know taxes can be scary, confusing, and frustrating. We also know many people just don’t want to deal with them anymore. Whether you’ve stumbled across this page or you’ve been sent here, we look forward to getting you the support you need.

If your question isn’t answered to the right or by scrolling down to a deeper dive, we encourage you to send your question our way sooner rather than later. The sooner we know what you need, the sooner we can provide a solution.

I need help before 2024 ends!

We’re offering year-end support though our 2025 Tax Season Preparedness Sessions. Click the link to learn a bit more. Or scroll below for some FAQs (yes, the link is down there, too).

What do I need to do before the year ends?

Year-end has a whole bunch of due dates and rules and plans to try to follow. It’s a lot. We know.

We send out emails to our clients (and onboarding clients) about things to look out for, be aware of, and do this time of year.

We’re not posting those emails to the FAQs this year. Year-end reminders are a benefit of being a Crayon Advisory, LLC client.

If you’re a current or onboarding client, please check your email. If you’re not finding them, send Megan an email or a message in Moxo and we’ll forward and help make sure the email(s) get to the top of your inbox.

If you’re not a current client, welcome! Head to our Intro Survey to get started with onboarding.

When does tax season kickoff?

We’ll start building Information Gathering Workspaces in Moxo as early as December 16th, 2024 for Entities and as early as January 6th, 2025 for Individuals.

We expect to have all Entity Information Gathering Workspaces for recurring clients and clients who onboard before November 30th released by January 24th, 2025 and February 21, 2025 for Indiviudals.

The IRS will open for filing sometime in January. We don’t know that date yet, and we likely won’t know until about three weeks before the date. We’ll come back here and update when we have more information.

Your tax return always starts with your Information Gathering Workspace in Moxo. This is where we’ll provide you with your engagement letter, keep you up to date on timelines and needs based on your tax return, and request the information we need to prepare your tax return.

What do you need to get started on my tax return?

The specifics to that question depends on you and your tax situtation. We’ll create an Information Gathering Workspace in our portal, Moxo, to customize the information we need from you.

That Workspace will include:

- Engagement Letter Signature Request;

- Initial Payment Invoice;

- Questionnaire(s) relevant to your personal situation;

- A list of documents or other information we need from you to complete your tax return;

- Moxo Requests and Tasks that will need to be addressed to get started on your tax return preparartion.

When do you need my information by?

Tax seaon 2025 will have some really strict timelines. the basics of this are:

- Pass-through entities (Partnership & S-Corporations) will need to provide complete information no later than February 14th, 2025 to receive an extension calculation before the March 17th, 2025 due date or by March 7th, 2025 to receive an extension calculation by April 15th, 2025. There will be no exceptions to this for the 2025 filing season.

- Individuals will need to provide complete initial information by March 21st, 2025 to receive an extension calculation by April 15th, 2025. There will be no exceptions to this for the 2025 filing season.

There’s more to come about this very soon as we build out more tax season communications.

I don't want to extend. How do I avoid that?

The best way to avoid an extension is to provide complete information as soon as possible. A few tips to reach that goal:

- Read the emails you receive;

- Add Megan’s email address and the Moxo Notification email address to your Important or Pirority Inbox to ensure all updates, reuqests, and other information comes to you directly (yes, we’ll provide you with specifics on that in your email);

- Upload the information you have as you receive it. Especially during filing season, Megan review information in Moxo on a daily basis. Anything you upload that isn’t what we need, Megan will leave a comment on and re-open the request. It’s okay to provide information as you receive it;

- Don’t wait until the last week possible to provide information. Historically, we receive over 75%+ of initial information in the last three days before the information is due. Each tax return we prepare takes between four and over 24+ hours to prepare, analyze, print, and deliver.

We extend tax returns to ensure we are filing a complete and accurate tax return. As professional tax preparers, we have a more extensive and specific requirement to gatehr complete inforamtion.

How quickly can I get my tax return?

The answer to that is a resounding, “it depends.” Megan will pick up, open up, work on, and complete your tax return as soon as possible. That process starts when you provide all of your initial information, and will re-start after you’ve provided additional information.

How do I know my Information Gathering Workspace is ready for me?

Your Information Gathering Workspace will be delivered through a series of emails and notifications:

- An email directly from Megan telling you your engagement letter and Information Gathering Workspace are is on the way.

- A notification regarding your Information Gathering Workspace in Moxo.

- Three days later, you’ll begin receiving a series of automated emails reminding you of that Information Gathering Workspace as well as important due dates you’ll need to meet.

What comes with my Information Gathering Workspace?

Moxo is your center everything about your tax return. Your Information Gathering Workspace will guide you through providing everything we need to prepare your tax return.

- 2025 Services Menu showing services offered, including details of your tax return preparation and additional services you may want (meetings, tax planning, and more). This will require acknowledgement.

- Engagement Letter defining the scope of the tax return preparation engagement. This requires a signature from all names on the tax return.

- Addendum(s) appropriate to your tax return, including timelines and due dates and terms and conditions. This requries acknoledgement.

- Initial Payment will be handled directly inside Moxo this year. No more digging for an email or link to an inovice. Invoices will be provided to business owners after payment is received and upon request to everyone else.

- Questionnaire(s) appropriate to your tax situation. As much as possible, these will all be inside Moxo this year.

- Information Request List is a checklist for your convenince of the specific documents we think we need from you. We create this before you complete your questionnaires, so it won’t include anything new we don’t know about.

- File Requests will be made for specific files we know we need to prepare your tax return. These requests mirror your Information Request List.

Your tax return may include other and additional information or requests based on your specific situation as well as changes to the process that may not be fully reflected in the FAQ. Moxo will drive the entire engagement.

Where can I find my Organizer? What about Questionnaires? And what's the difference?

Your Information Gathering WorkFlow in Moxo will include certain questionnaires we need you to complete. If you or your spouse own a business, the business owner will need to be the one to complete the related questionnaire.

Most of these are standardized. However, some of these questionnaires may be partially or even completely customized to you and your tax situation.

In the past, we’ve been like other preparers and called these, “Organizers.” With the 2024 tax season, we started calling these, “Questionnaires,” to better reflect both how they show up for you and what they’re doing.

Can I just send you my information over email?

Email is a great tool to reach out, ask a question, or otherwise start a conversation. That moment when you know you need help but you’re not sure? Email is a great place to just send a few words my way and move the needle forward.

As wonderful as email is, it’s not secure, and should not be used for transmitting anything with something you’d want handled with discretion.

We use Moxo, a conversation based portal, to tranfser and share information securely.

Our email automatically removes attachments at the server for your and every other client’s protection. If you receive a notice, you’ll need to upload it to Moxo, preferrably as a PDF. Please remember to upload all pages of a notice you receive.

Tax season 2025 FAQ

We’re just as excited about the 2025 Tax Season as you are.

Besides doing some tax planning and projections, a look-back and reset or two, and even some late filings, we’re spending time behind the scenes to make this coming tax season as smooth and easy as possible.

We know taxes can be scary, confusing, and frustrating. We also know many people just don’t want to deal with them anymore. Whether you’ve stumbled across this page or you’ve been sent here, we look forward to getting you the support you need.

If your question isn’t answered to the right or by scrolling down to a deeper dive, we encourage you to send your question our way sooner rather than later. The sooner we know what you need, the sooner we can provide a solution.

I need help before 2024 ends!

We’re offering year-end support though our 2025 Tax Season Preparedness Sessions. Click the link to learn a bit more. Or scroll below for some FAQs (yes, the link is down there, too).

What do I need to do before the year ends?

Year-end has a whole bunch of due dates and rules and plans to try to follow. It’s a lot. We know.

We send out emails to our clients (and onboarding clients) about things to look out for, be aware of, and do this time of year.

We’re not posting those emails to the FAQs this year. Year-end reminders are a benefit of being a Crayon Advisory, LLC client.

If you’re a current or onboarding client, please check your email. If you’re not finding them, send Megan an email or a message in Moxo and we’ll forward and help make sure the email(s) get to the top of your inbox.

If you’re not a current client, welcome! Head to our Intro Survey to get started with onboarding.

When does tax season kickoff?

We’ll start building Information Gathering Workspaces in Moxo as early as December 16th, 2024 for Entities and as early as January 6th, 2025 for Individuals.

We expect to have all Entity Information Gathering Workspaces for recurring clients and clients who onboard before November 30th released by January 24th, 2025 and February 21, 2025 for Indiviudals.

The IRS will open for filing sometime in January. We don’t know that date yet, and we likely won’t know until about three weeks before the date. We’ll come back here and update when we have more information.

Your tax return always starts with your Information Gathering Workspace in Moxo. This is where we’ll provide you with your engagement letter, keep you up to date on timelines and needs based on your tax return, and request the information we need to prepare your tax return.

What do you need to get started on my tax return?

The specifics to that question depends on you and your tax situtation. We’ll create an Information Gathering Workspace in our portal, Moxo, to customize the information we need from you.

That Workspace will include:

- Engagement Letter Signature Request;

- Initial Payment Invoice;

- Questionnaire(s) relevant to your personal situation;

- A list of documents or other information we need from you to complete your tax return;

- Moxo Requests and Tasks that will need to be addressed to get started on your tax return preparartion.

When do you need my information by?

Tax seaon 2025 will have some really strict timelines. the basics of this are:

- Pass-through entities (Partnership & S-Corporations) will need to provide complete information no later than February 14th, 2025 to receive an extension calculation before the March 17th, 2025 due date or by March 7th, 2025 to receive an extension calculation by April 15th, 2025. There will be no exceptions to this for the 2025 filing season.

- Individuals will need to provide complete initial information by March 21st, 2025 to receive an extension calculation by April 15th, 2025. There will be no exceptions to this for the 2025 filing season.

There’s more to come about this very soon as we build out more tax season communications.

I don't want to extend. How do I avoid that?

The best way to avoid an extension is to provide complete information as soon as possible. A few tips to reach that goal:

- Read the emails you receive;

- Add Megan’s email address and the Moxo Notification email address to your Important or Pirority Inbox to ensure all updates, reuqests, and other information comes to you directly (yes, we’ll provide you with specifics on that in your email);

- Upload the information you have as you receive it. Especially during filing season, Megan review information in Moxo on a daily basis. Anything you upload that isn’t what we need, Megan will leave a comment on and re-open the request. It’s okay to provide information as you receive it;

- Don’t wait until the last week possible to provide information. Historically, we receive over 75%+ of initial information in the last three days before the information is due. Each tax return we prepare takes between four and over 24+ hours to prepare, analyze, print, and deliver.

We extend tax returns to ensure we are filing a complete and accurate tax return. As professional tax preparers, we have a more extensive and specific requirement to gatehr complete inforamtion.

How quickly can I get my tax return?

The answer to that is a resounding, “it depends.” Megan will pick up, open up, work on, and complete your tax return as soon as possible. That process starts when you provide all of your initial information, and will re-start after you’ve provided additional information.

How do I know my Information Gathering Workspace is ready for me?

Your Information Gathering Workspace will be delivered through a series of emails and notifications:

- An email directly from Megan telling you your engagement letter and Information Gathering Workspace are is on the way.

- A notification regarding your Information Gathering Workspace in Moxo.

- Three days later, you’ll begin receiving a series of automated emails reminding you of that Information Gathering Workspace as well as important due dates you’ll need to meet.

What comes with my Information Gathering Workspace?

Moxo is your center everything about your tax return. Your Information Gathering Workspace will guide you through providing everything we need to prepare your tax return.

- 2025 Services Menu showing services offered, including details of your tax return preparation and additional services you may want (meetings, tax planning, and more). This will require acknowledgement.

- Engagement Letter defining the scope of the tax return preparation engagement. This requires a signature from all names on the tax return.

- Addendum(s) appropriate to your tax return, including timelines and due dates and terms and conditions. This requries acknoledgement.

- Initial Payment will be handled directly inside Moxo this year. No more digging for an email or link to an inovice. Invoices will be provided to business owners after payment is received and upon request to everyone else.

- Questionnaire(s) appropriate to your tax situation. As much as possible, these will all be inside Moxo this year.

- Information Request List is a checklist for your convenince of the specific documents we think we need from you. We create this before you complete your questionnaires, so it won’t include anything new we don’t know about.

- File Requests will be made for specific files we know we need to prepare your tax return. These requests mirror your Information Request List.

Your tax return may include other and additional information or requests based on your specific situation as well as changes to the process that may not be fully reflected in the FAQ. Moxo will drive the entire engagement.

Where can I find my Organizer? What about Questionnaires? And what's the difference?

Your Information Gathering WorkFlow in Moxo will include certain questionnaires we need you to complete. If you or your spouse own a business, the business owner will need to be the one to complete the related questionnaire.

Most of these are standardized. However, some of these questionnaires may be partially or even completely customized to you and your tax situation.

In the past, we’ve been like other preparers and called these, “Organizers.” With the 2024 tax season, we started calling these, “Questionnaires,” to better reflect both how they show up for you and what they’re doing.

Can I just send you my information over email?

Email is a great tool to reach out, ask a question, or otherwise start a conversation. That moment when you know you need help but you’re not sure? Email is a great place to just send a few words my way and move the needle forward.

As wonderful as email is, it’s not secure, and should not be used for transmitting anything with something you’d want handled with discretion.

We use Moxo, a conversation based portal, to tranfser and share information securely.

Our email automatically removes attachments at the server for your and every other client’s protection. If you receive a notice, you’ll need to upload it to Moxo, preferrably as a PDF. Please remember to upload all pages of a notice you receive.

What are these sessions?

These sessions are loosely guided virtual meetings with as time set aside for you to do the things you need to do at and before year-end. There will likely be others in attendance. Attendance is limited to 10 people per session.

What will we do?

I have a loose plan in mind for each session. I’ll share that below, but, these plans may change based on attendee’s needs:

- Session 1: What information do businesses need to gather? What needs to happen before year-end?

- Session 2: Last-minute things to do before year end. Understand payroll bonuses, collections, purchases, and donations.

- Session 3: Repeat & mixed bag of sessions 1 & 2.

- Session 4: Payroll reporting, 1099s, personal property taxes, and other reporting that may need to happen in 2025.

- Session 5: Reconciling activity through year-end, reviewing Accounts Receivable and Payable, reviewing payroll results, dealing with things that didn’t get taken care of in 2024 but may should have been.

What's the cost?

One session is $127. You can buy a bundle of three sessions for $297. If you prefer the 1:1 session, these are $427.

Will I get to speak with you directly about my problem/issue?

Very likely, yes.

These sessions have been designed to allow for me to set up a break-out room in which we can discuss your specific need privately. You’ll also be able to share your screen so I can guide you to the right button to click and get the things done.

Breakout rooms are intended to be short, quick solutions.

I kind of like this format. Will you do more of it?

Yes!

This format is something I’ve wanted to offer for a while. I’ve tried a couple of times in the past and it’s not quite stuck. Fingers crossed this keeps working and the third time is a charm.

I don't like group activities.

Frankly, me neither! That’s the beauty of these: you’re not working together on a common goal. Your working on similar goals in community with each other.

And the signup form has an option for private, 1:1 sessions instead. These will be different than the group sessions.

What happens if I can't or don't make it?

I’m very busy/forgetful/virtual meetings like this are hard for me/I have social anxiety and may not be able to attend/what if an elephant walks through my door?

I understand life happens. I really do. I try to be as accommodating as possible. If there are sessions left, (i.e. it’s not the last session), I’d be happy to send you an invitation to another session.

As with any meeting, I’ll send a follow-up after the meeting to capture reminders and anything major discussed. These will be individualized for anyone who was in a breakout room with me.

The day or time doesn't work for me.

I’m very sorry Thursdays at 10:30 PST aren’t a super great time for you. I’ll over you a few solutions:

- Send me your questions – Current clients can send me an email or ask a question in Moxo; new, onboarding, prospective, or otherwise non-clients can use the sign-up form or this Contact Us Form to get a conversation started);

- Come late or leave early! I won’t be offended. If you’re more than 15 minutes late, you may need to hang out in the virtual, “waiting room,” if I’m in a breakout session with someone.

- Have a private, 1:1 session (available through the Sign-up Form).

The fact of the matter is that there are no good times for things like this. I’d rather offer a solution of some sort than nothing at all.

What will you be doing during this co-working time?

Mostly, I’ll be making myself available to you.

I may click a few buttons of my own that I need to. I may color in a coloring book. I may knit or build or otherwise create something neat.

Unless I’m speaking or in a breakout room with someone, I’ll be muted and ready to help with questions you may have.

Do I have to do this?

You’re an adult. I can’t force you to do anything.

If you find yourself with questions about year-end, tax season, your tax return next year, and similar subjects, I encourage you to sign up for at least one session and attend.

I don't want to use the sign-up form. Can you just bill me?

I’ll need you to use the sign-up form at least once. That form is gathering information that’s helpful to me to help you. If you sign up for one session and decide you’d like to attend more/others, I can bill you instead of of you using the signup form for those subsequent sessions.

Who will be there?

You will be there. I will be there. Likely one or two or more others will be there as well. We’ll have a few minutes of introductions. No one will be forced to turn on their cameras, speak, or do anything they’re not comfortable with doing.

Is there a Code of Conduct?

Yes! The Code of Conduct is simply stated: don’t be a mean or aggravating person. If you’re nerdy like me, you can also consider Wheaton’s Law to be in effect.

A few more words: no isms. No actual isms or perceived isms (that includes racism, sexism, transphobia, homophobia, classism, or elitism).

I’ll follow ouch and oops – if you say something that is or might be considered mean or aggravating, I will say ouch (and I’ll encourage others to do so as well). You’ll be encouraged to say oops and move on. If you’d like more education, more can be offered at a later time. If you recognize yourself saying something you’re not super proud of, say oops and move on.

Part of life is learning to be a better human. I learn something about this every day. There’s no reason learning can’t happen in this context.

We Know half the battle is knowing what’s coming

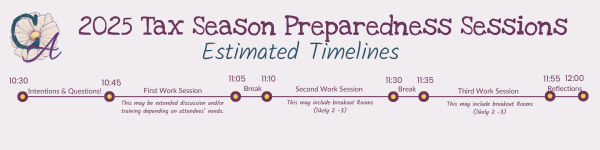

2025 Tax Season Preparedness Sessions

So we’ve put together a series of sessions designed to help you be as prepared as possible. Click these words to head directly to the signup form

These sessions will happen weekly on Thursdays from 10:30PST to noon. You don’t have to come at the start, and you don’t have to stay for the whole thing.

Sessions are inspired by the concept of co-working: that you are and can be more productive when there’s someone else doing the same or a similar thing to you. It’s a tiny bit of accountability with celebrations and achievable expectations. Megan will be there to guide, assist, and facilitate. Your question or struggle may also be someone else’s. They may be able to tackle it because of your bravery. And vice-versa.

We know half the battle is knowing what’s coming.

Tax Season 2025 Preparedness Sessions

So we’ve put together a series of sessions designed to help you be as prepared as possible. Click these words to head directly to the signup form

These sessions will happen weekly on Thursdays from 10:30PST to noon. You don’t have to come at the start, and you don’t have to stay for the whole thing.

Sessions are inspired by the concept of co-working: that you are and can be more productive when there’s someone else doing the same or a similar thing to you. It’s a tiny bit of accountability with celebrations and achievable expectations. Megan will be there to guide, assist, and facilitate. Your question or struggle may also be someone else’s. They may be able to tackle it because of your bravery. And vice-versa.

What are these sessions?

These sessions are loosely guided virtual meetings with as time set aside for you to do the things you need to do at and before year-end. There will likely be others in attendance. Attendance is limited to 10 people per session.

What will we do?

I have a loose plan in mind for each session. I’ll share that below, but, these plans may change based on attendee’s needs:

- Session 1: What information do businesses need to gather? What needs to happen before year-end?

- Session 2: Last-minute things to do before year end. Understand payroll bonuses, collections, purchases, and donations.

- Session 3: Repeat & mixed bag of sessions 1 & 2.

- Session 4: Payroll reporting, 1099s, personal property taxes, and other reporting that may need to happen in 2025.

- Session 5: Reconciling activity through year-end, reviewing Accounts Receivable and Payable, reviewing payroll results, dealing with things that didn’t get taken care of in 2024 but may should have been.

What's the cost?

One session is $127. You can buy a bundle of three sessions for $297. If you prefer the 1:1 session, these are $427.

Will I get to speak with you directly about my problem/issue?

Very likely, yes.

These sessions have been designed to allow for me to set up a break-out room in which we can discuss your specific need privately. You’ll also be able to share your screen so I can guide you to the right button to click and get the things done.

Breakout rooms are intended to be short, quick solutions.

I kind of like this format. Will you do more of it?

Yes!

This format is something I’ve wanted to offer for a while. I’ve tried a couple of times in the past and it’s not quite stuck. Fingers crossed this keeps working and the third time is a charm.

I don't like group activities.

Frankly, me neither! That’s the beauty of these: you’re not working together on a common goal. Your working on similar goals in community with each other.

And the signup form has an option for private, 1:1 sessions instead. These will be different than the group sessions.

What happens if I can't or don't make it?

I’m very busy/forgetful/virtual meetings like this are hard for me/I have social anxiety and may not be able to attend/what if an elephant walks through my door?

I understand life happens. I really do. I try to be as accommodating as possible. If there are sessions left, (i.e. it’s not the last session), I’d be happy to send you an invitation to another session.

As with any meeting, I’ll send a follow-up after the meeting to capture reminders and anything major discussed. These will be individualized for anyone who was in a breakout room with me.

The day or time doesn't work for me.

I’m very sorry Thursdays at 10:30 PST aren’t a super great time for you. I’ll over you a few solutions:

- Send me your questions – Current clients can send me an email or ask a question in Moxo; new, onboarding, prospective, or otherwise non-clients can use the sign-up form or this Contact Us Form to get a conversation started);

- Come late or leave early! I won’t be offended. If you’re more than 15 minutes late, you may need to hang out in the virtual, “waiting room,” if I’m in a breakout session with someone.

- Have a private, 1:1 session (available through the Sign-up Form).

The fact of the matter is that there are no good times for things like this. I’d rather offer a solution of some sort than nothing at all.

What will you be doing during this co-working time?

Mostly, I’ll be making myself available to you.

I may click a few buttons of my own that I need to. I may color in a coloring book. I may knit or build or otherwise create something neat.

Unless I’m speaking or in a breakout room with someone, I’ll be muted and ready to help with questions you may have.

Do I have to do this?

You’re an adult. I can’t force you to do anything.

If you find yourself with questions about year-end, tax season, your tax return next year, and similar subjects, I encourage you to sign up for at least one session and attend.

I don't want to use the sign-up form. Can you just bill me?

I’ll need you to use the sign-up form at least once. That form is gathering information that’s helpful to me to help you. If you sign up for one session and decide you’d like to attend more/others, I can bill you instead of of you using the signup form for those subsequent sessions.

Who will be there?

You will be there. I will be there. Likely one or two or more others will be there as well. We’ll have a few minutes of introductions. No one will be forced to turn on their cameras, speak, or do anything they’re not comfortable with doing.

Is there a Code of Conduct?

Yes! The Code of Conduct is simply stated: don’t be a mean or aggravating person. If you’re nerdy like me, you can also consider Wheaton’s Law to be in effect.

A few more words: no isms. No actual isms or perceived isms (that includes racism, sexism, transphobia, homophobia, classism, or elitism).

I’ll follow ouch and oops – if you say something that is or might be considered mean or aggravating, I will say ouch (and I’ll encourage others to do so as well). You’ll be encouraged to say oops and move on. If you’d like more education, more can be offered at a later time. If you recognize yourself saying something you’re not super proud of, say oops and move on.

Part of life is learning to be a better human. I learn something about this every day. There’s no reason learning can’t happen in this context.