Tax

Season

2026 FAQ

Tax season 2026 FAQ

We’re just as excited about the 2026 Tax Season as you are.

Besides doing some tax planning and projections, a look-back and reset or two, and even some late filings, we’re spending time behind the scenes to make this coming tax season as smooth and easy as possible.

We know taxes can be scary, confusing, and frustrating. We also know many people just don’t want to deal with them anymore. Whether you’ve stumbled across this page or you’ve been sent here, we look forward to getting you the support you need.

If your question isn’t answered to the right or by scrolling down to a deeper dive, we encourage you to send your question our way sooner rather than later. The sooner we know what you need, the sooner we can provide a solution.

I need help before 2025 ends!

We’re offering year-end support though our 2026 Tax Season Preparedness Sessions. Click the link to learn a bit more. Or scroll below for some FAQs (yes, the link is down there, too).

Will I pay tax on tips?

That’s a good question, and the answer is: it depends.

In July of 2025, certain deductions became available for employees and certain small business owners who receive income in hte form of qualified tips. Generally speaking, qualified tips are:

- Included as wages on your W2 in Box 1 or 7

- Might be reported to your employer on Form 4070

- Might be reported on your tax return on Form 4137

- For self-employed individuals, might be included on your 1099-K or on other records

This deduction is limited to individuals who work in certain sectors (generally restaurants and certain enterntainment, though there are a few other industries who may also qualify). There are also deduction and income limitations.

We’re reaching out to our current clients who may qualify (or whose businesses may qualify or have reporting obligations) at hte end of November. If you think you might qualify and we haven’t reached out to you yet, please do so! Planning options are available.

Will I pay tax on overtime?

That’s a good question, and the answer is: it depends.

In July of 2025, certain deductions became available for, “non-exempt,” employees who receive overtime pay.

The details of this are too many to get into in an FAQ. That said, we’re asking all of our clients during tax return preparation if they received or think they may have received overtime pay in 2025. If the answer is yes, we’ll ask you a few additional questions and for your last paystub from 2025 to help determine if you qualify for the deduction.

For 2025, employers will not be required to report this information on your W2s. Employers do have guidance available to report this information to their employees for 2025, so it may be on your W2! To be on the safe side, we’ll likely ask for that paystub regardless.

Will I pay tax on Social Security?

That’s a good question, and the answer is: not exactly, no.

In July of 2025, an additional deduction of up to $6,000 for individuals over the age of 65 (married filing joint couples may qualify for a deduction up to $12,000).

This deduction is subject to certain phase outs.

If you recieve social security, the taxability of that social security will be dependent on the rest of your income. Tax planning and projections can help answer these questions more specifically and thoroughly.

I'm an employer - do I have to report anything differently for 2025?

If you’re an employer with employees who work overtime and/or receive tips, you do have new reporting requirements. The IRS is offering transitional penalty releive for 2025 even if the necessary information is not reported on your employees’ 2025 W2s.

That said, you should consider:

- Collecting all qualified tip information from your employees

- Ensuring your payroll system is able to report overtime paid to your employees and that it’s clear what is being reported – either 100% of the overtime wages paid or if, “straight,” and, “premium,” overtime wages are separated out.

We’re reaching out in the last week of November to employers who haven’t discussed this with us already.

What do I need to do before the year ends?

Year-end has a whole bunch of due dates and rules and plans to try to follow. It’s a lot. We know.

We send out emails to our clients (and onboarding clients) about things to look out for, be aware of, and do this time of year.

We’re not posting those emails to the FAQs this year. Year-end reminders are a benefit of being a Crayon Advisory, LLC client.

If you’re a current or onboarding client, please check your email. If you’re not finding them, send Megan an email or a message in Acounta and we’ll forward and help make sure the email(s) get to the top of your inbox.

If you’re not a current client, welcome! Head to our Intro Survey to get started with onboarding.

When does tax season kickoff?

Things are changing for the 2026 filing season (2025 tax returns). Besides a new portal, we’re also scheduling as much as possile in advance. If you haven’t made your scheduling preferences known, you can do so here.

This scheduling is set up so we can stagger Engagement Letter and Information Requests and get started on tax return preparation for entities who are ready to go in early January.

We don’t know when the IRS will open for the 2026 filing season. We likely won’t know until about three weeks before the date. We’ll come back here and update when we have more information.

Your tax return always starts with your Engagement Letter, Information Requests, and Questionnaire(s). These will all be available inside Acounta as they’re released to you based on your scheduling preferences.

What do you need to get started on my tax return?

The specifics to that question depends on you and your tax situtation. We’ll release your Engagement Letter and Initial Information Requests based on your scheduling preferences. These will all be available inside Acounta.

If you want to get a head start, you can use the Information Request List from your 2024 tax return as a starting point for the items we’re likely to ask for. Do keep in mind these are updated annually, so there may be more or less information necessary for your 2025 tax return.

When do you need my information by?

Tax Season 2026 will have some really strict timelines. These are all disclosed in the Seasonal Scheduling.

Date availability is subject to change.

- Pass-through entities (Partnership & S-Corporations) will need to provide complete information by the following staggered dates:

- January 16th (5 total slots available)

- January 23rd (5 total slots available)

- January 30th (2 total slots available)

- February 6th (2 total slots available)

- February 10th (1 total slots available)

- If these dates are impossible for you, your pass-through entity return will almost certainly be extended and completed over the summer and into the fall. Additional information will be provided when you select your date.

- Individuals will need to provide information by the following staggered dates:

- February 6th (17 total slots available)

- February 13th (17 total slots available)

- February 20th (17 total slots available)

- February 27th (13 total slots available)

- March 6th (13 total slots available)

- March 13th (8 total slots available)

- If these dates are impossible for you, your individual tax return will be extended and we will not likely be able to provide you with an extension calculation.

Change is hard and scary. We understand things happen and plans may need to change or shift. We will remain as flexible as possible and communicate changes in expectations if and as necessary.

I don't want to extend. How do I avoid that?

The best way to avoid an extension is to provide complete information as soon as possible. A few tips to reach that goal:

- Read the emails you receive;

- Add Megan’s email address and the Acounta no reply email address to your Important or Pirority Inbox to ensure all updates, requests, and other information comes to you directly (yes, we’ll provide you with specifics on that in your email);

- Upload the information you have as you receive it. Especially during filing season, Megan reviews documents uploaded in Acounta on a daily basis. Anything you upload that isn’t what we need, Megan will leave a comment on and re-open the request. It’s okay to provide information as you receive it;

- The initial information due date you select will drive all of your 2025 tax return preparation. Select a date that will work as well as possible for you. Especially if you need or want a later date, be sure to make your selection early. Dates later in the tax season are less available and will be selected first.

We extend tax returns to ensure we are filing a complete and accurate tax return. As professional tax preparers, we have a more extensive and specific requirement to gatehr complete inforamtion.

How quickly can I get my tax return?

The answer to that is a resounding, “it depends.” Megan will pick up, open up, work on, and complete your tax return as soon as possible. That process starts when you provide all of your initial information, and will re-start after you’ve provided additional information.

How do I know you have requested all of my information?

Your Initial Information will be requested through a series of emails and notifications:

- An email directly from Megan telling you your engagement letter and requests are is on the way.

- Separate notifications your Engagement Letter is ready for you to sign, you have questionnaires to complete, and you have Document Requests made will be sent to you through Acounta. Watch your email for details.

- Three days later, you’ll begin receiving a series of automated emails reminding you of the requests being ready for you as well as important due dates you’ll need to meet.

What is available in Acounta when my requests are released?

Acounta is your center everything about your tax return. You’ll be notified of a number of actions to take when they are ready for you to take them. You will also receive:

- 2026 Services Menu showing services offered, including details of your tax return preparation and additional services you may want (meetings, tax planning, and more). This will require acknowledgement.

- Engagement Letter defining the scope of the tax return preparation engagement. This requires a signature from all names on the tax return.

- Addendum(s) appropriate to your tax return, including timelines and due dates and terms and conditions. This requries acknoledgement.

- Initial Payment will be handled directly inside Acounta this year.

- Questionnaire(s) appropriate to your tax situation. As much as possible, these will all be inside Acounta this year.

- Information Request List is a checklist for your convenince of the specific documents we think we need from you. We create this before you complete your questionnaires, so it won’t include anything new we don’t know about.

- File Requests will be made for specific files we know we need to prepare your tax return. These requests mirror your Information Request List.

Your tax return may include other and additional information or requests based on your specific situation as well as changes to the process that may not be fully reflected in the FAQ. Acounta will drive the entire engagement.

Where can I find my Organizer? What about Questionnaires? And what's the difference?

You will have certain questionnaires to compelte in your Questionnaires tab in Acounta. If you or your spouse own a business, the business owner will need to be the one to complete the related questionnaire.

Most of these are standardized. However, some of these questionnaires may be partially or even completely customized to you and your tax situation.

In the past, we’ve been like other preparers and called these, “Organizers.” With the 2024 tax season, we started calling these, “Questionnaires,” to better reflect both how they show up for you and what they’re doing.

Can I just send you my information over email?

Short answer: No.

Email is a great tool to reach out, ask a question, or otherwise start a conversation. That moment when you know you need help but you’re not sure? Email is a great place to just send a few words my way and move the needle forward.

As wonderful as email is, it’s not secure, and should not be used for transmitting anything with something you’d want handled with discretion.

We use Acounta for all secure client communications and as a place for you to safely upload files.

Our email automatically removes attachments at the server for your and every other client’s protection. If you receive a notice, you’ll need to upload it to Acounta, preferrably as a PDF. Please remember to upload all pages of a notice you receive.

Tax season 2026 FAQ

We’re just as excited about the 2026 Tax Season as you are.

Besides doing some tax planning and projections, a look-back and reset or two, and even some late filings, we’re spending time behind the scenes to make this coming tax season as smooth and easy as possible.

We know taxes can be scary, confusing, and frustrating. We also know many people just don’t want to deal with them anymore. Whether you’ve stumbled across this page or you’ve been sent here, we look forward to getting you the support you need.

If your question isn’t answered to the right or by scrolling down to a deeper dive, we encourage you to send your question our way sooner rather than later. The sooner we know what you need, the sooner we can provide a solution.

I need help before 2025 ends!

We’re offering year-end support though our 2026 Tax Season Preparedness Sessions. Click the link to learn a bit more. Or scroll below for some FAQs (yes, the link is down there, too).

What do I need to do before the year ends?

Year-end has a whole bunch of due dates and rules and plans to try to follow. It’s a lot. We know.

We send out emails to our clients (and onboarding clients) about things to look out for, be aware of, and do this time of year.

We’re not posting those emails to the FAQs this year. Year-end reminders are a benefit of being a Crayon Advisory, LLC client.

If you’re a current or onboarding client, please check your email. If you’re not finding them, send Megan an email or a message in Acounta and we’ll forward and help make sure the email(s) get to the top of your inbox.

If you’re not a current client, welcome! Head to our Intro Survey to get started with onboarding.

When does tax season kickoff?

Things are changing for the 2026 filing season (2025 tax returns). Besides a new portal, we’re also scheduling as much as possile in advance. If you haven’t made your scheduling preferences known, you can do so here.

This scheduling is set up so we can stagger Engagement Letter and Information Requests and get started on tax return preparation for entities who are ready to go in early January.

We don’t know when the IRS will open for the 2026 filing season. We likely won’t know until about three weeks before the date. We’ll come back here and update when we have more information.

Your tax return always starts with your Engagement Letter, Information Requests, and Questionnaire(s). These will all be available inside Acounta as they’re released to you based on your scheduling preferences.

What do you need to get started on my tax return?

The specifics to that question depends on you and your tax situtation. We’ll release your Engagement Letter and Initial Information Requests based on your scheduling preferences. These will all be available inside Acounta.

If you want to get a head start, you can use the Information Request List from your 2024 tax return as a starting point for the items we’re likely to ask for. Do keep in mind these are updated annually, so there may be more or less information necessary for your 2025 tax return.

When do you need my information by?

Tax Season 2026 will have some really strict timelines. These are all disclosed in the Seasonal Scheduling.

Date availability is subject to change.

- Pass-through entities (Partnership & S-Corporations) will need to provide complete information by the following staggered dates:

- January 16th (5 total slots available)

- January 23rd (5 total slots available)

- January 30th (2 total slots available)

- February 6th (2 total slots available)

- February 10th (1 total slots available)

- If these dates are impossible for you, your pass-through entity return will almost certainly be extended and completed over the summer and into the fall. Additional information will be provided when you select your date.

- Individuals will need to provide information by the following staggered dates:

- February 6th (17 total slots available)

- February 13th (17 total slots available)

- February 20th (17 total slots available)

- February 27th (13 total slots available)

- March 6th (13 total slots available)

- March 13th (8 total slots available)

- If these dates are impossible for you, your individual tax return will be extended and we will not likely be able to provide you with an extension calculation.

Change is hard and scary. We understand things happen and plans may need to change or shift. We will remain as flexible as possible and communicate changes in expectations if and as necessary.

I don't want to extend. How do I avoid that?

The best way to avoid an extension is to provide complete information as soon as possible. A few tips to reach that goal:

- Read the emails you receive;

- Add Megan’s email address and the Acounta no reply email address to your Important or Pirority Inbox to ensure all updates, requests, and other information comes to you directly (yes, we’ll provide you with specifics on that in your email);

- Upload the information you have as you receive it. Especially during filing season, Megan reviews documents uploaded in Acounta on a daily basis. Anything you upload that isn’t what we need, Megan will leave a comment on and re-open the request. It’s okay to provide information as you receive it;

- The initial information due date you select will drive all of your 2025 tax return preparation. Select a date that will work as well as possible for you. Especially if you need or want a later date, be sure to make your selection early. Dates later in the tax season are less available and will be selected first.

We extend tax returns to ensure we are filing a complete and accurate tax return. As professional tax preparers, we have a more extensive and specific requirement to gatehr complete inforamtion.

How quickly can I get my tax return?

The answer to that is a resounding, “it depends.” Megan will pick up, open up, work on, and complete your tax return as soon as possible. That process starts when you provide all of your initial information, and will re-start after you’ve provided additional information.

How do I know you have requested all of my information?

Your Initial Information will be requested through a series of emails and notifications:

- An email directly from Megan telling you your engagement letter and requests are is on the way.

- Separate notifications your Engagement Letter is ready for you to sign, you have questionnaires to complete, and you have Document Requests made will be sent to you through Acounta. Watch your email for details.

- Three days later, you’ll begin receiving a series of automated emails reminding you of the requests being ready for you as well as important due dates you’ll need to meet.

What is available in Acounta when my requests are released?

Acounta is your center everything about your tax return. You’ll be notified of a number of actions to take when they are ready for you to take them. You will also receive:

- 2026 Services Menu showing services offered, including details of your tax return preparation and additional services you may want (meetings, tax planning, and more). This will require acknowledgement.

- Engagement Letter defining the scope of the tax return preparation engagement. This requires a signature from all names on the tax return.

- Addendum(s) appropriate to your tax return, including timelines and due dates and terms and conditions. This requries acknoledgement.

- Initial Payment will be handled directly inside Acounta this year.

- Questionnaire(s) appropriate to your tax situation. As much as possible, these will all be inside Acounta this year.

- Information Request List is a checklist for your convenince of the specific documents we think we need from you. We create this before you complete your questionnaires, so it won’t include anything new we don’t know about.

- File Requests will be made for specific files we know we need to prepare your tax return. These requests mirror your Information Request List.

Your tax return may include other and additional information or requests based on your specific situation as well as changes to the process that may not be fully reflected in the FAQ. Acounta will drive the entire engagement.

Where can I find my Organizer? What about Questionnaires? And what's the difference?

You will have certain questionnaires to compelte in your Questionnaires tab in Acounta. If you or your spouse own a business, the business owner will need to be the one to complete the related questionnaire.

Most of these are standardized. However, some of these questionnaires may be partially or even completely customized to you and your tax situation.

In the past, we’ve been like other preparers and called these, “Organizers.” With the 2024 tax season, we started calling these, “Questionnaires,” to better reflect both how they show up for you and what they’re doing.

Can I just send you my information over email?

Short answer: No.

Email is a great tool to reach out, ask a question, or otherwise start a conversation. That moment when you know you need help but you’re not sure? Email is a great place to just send a few words my way and move the needle forward.

As wonderful as email is, it’s not secure, and should not be used for transmitting anything with something you’d want handled with discretion.

We use Acounta for all secure client communications and as a place for you to safely upload files.

Our email automatically removes attachments at the server for your and every other client’s protection. If you receive a notice, you’ll need to upload it to Acounta, preferrably as a PDF. Please remember to upload all pages of a notice you receive.

What are these sessions?

These sessions are loosely guided virtual meetings with as time set aside for you to do the things you need to do at and before year-end. There will likely be others in attendance. Attendance is limited to 10 people per session.

What will we do?

I have a loose plan in mind for each session. I’ll share that below, but, these plans may change based on attendee’s needs:

- Session 1: What information do businesses need to gather? What needs to happen before year-end?

- Session 2: Last-minute things to do before year end. Understand payroll bonuses, collections, purchases, and donations.

- Session 3: Repeat & mixed bag of sessions 1 & 2.

- Session 4: Payroll reporting, 1099s, personal property taxes, and other reporting that may need to happen in 2026.

- Session 5: Reconciling activity through year-end, reviewing Accounts Receivable and Payable, reviewing payroll results, dealing with things that didn’t get taken care of in 2024 but may should have been.

What's the cost?

One session is $147. You can buy a bundle of three sessions for $327. If you prefer the 1:1 session, these are $447.

Will I get to speak with you directly about my problem/issue?

Very likely, yes.

These sessions have been designed to allow for me to set up a break-out room in which we can discuss your specific need privately. You’ll also be able to share your screen so I can guide you to the right button to click and get the things done.

Breakout rooms are intended to be short, quick solutions.

I kind of like this format. Will you do more of it?

Yes!

This format is something I’ve wanted to offer for a while. I’ve tried a couple of times in the past and it’s not quite stuck. Fingers crossed this keeps working and the third time is a charm.

I don't like group activities.

Frankly, me neither! That’s the beauty of these: you’re not working together on a common goal. Your working on similar goals in community with each other.

And the signup form has an option for private, 1:1 sessions instead. These will be different than the group sessions.

What happens if I can't or don't make it?

I’m very busy/forgetful/virtual meetings like this are hard for me/I have social anxiety and may not be able to attend/what if an elephant walks through my door?

I understand life happens. I really do. I try to be as accommodating as possible. If there are sessions left, (i.e. it’s not the last session), I’d be happy to send you an invitation to another session.

As with any meeting, I’ll send a follow-up after the meeting to capture reminders and anything major discussed. These will be individualized for anyone who was in a breakout room with me.

The day or time doesn't work for me.

I’m very sorry Tuesdays at 10:30 PST aren’t a super great time for you. I’ll over you a few solutions:

- Send me your questions – Current clients can send me an email or ask a question in Acounta; new, onboarding, prospective, or otherwise non-clients can use the sign-up form or this Contact Us Form to get a conversation started);

- Come late or leave early! I won’t be offended. If you’re more than 15 minutes late, you may need to hang out in the virtual, “waiting room,” if I’m in a breakout session with someone.

- Have a private, 1:1 session (available through the Sign-up Form).

The fact of the matter is that there are no good times for things like this. I’d rather offer a solution of some sort than nothing at all.

What will you be doing during this co-working time?

Mostly, I’ll be making myself available to you.

I may click a few buttons of my own that I need to. I may color in a coloring book. I may knit or build or otherwise create something neat.

Unless I’m speaking or in a breakout room with someone, I’ll be muted and ready to help with questions you may have.

Do I have to do this?

You’re an adult. I can’t force you to do anything.

If you find yourself with questions about year-end, tax season, your tax return next year, and similar subjects, I encourage you to sign up for at least one session and attend.

I don't want to use the sign-up form. Can you just bill me?

I’ll need you to use the sign-up form at least once. That form is gathering information that’s helpful to me to help you. If you sign up for one session and decide you’d like to attend more/others, I can bill you instead of of you using the signup form for those subsequent sessions.

Who will be there?

You will be there. I will be there. Likely one or two or more others will be there as well. We’ll have a few minutes of introductions. No one will be forced to turn on their cameras, speak, or do anything they’re not comfortable with doing.

Is there a Code of Conduct?

Yes! The Code of Conduct is simply stated: don’t be a mean or aggravating person. If you’re nerdy like me, you can also consider Wheaton’s Law to be in effect.

A few more words: no isms. No actual isms or perceived isms (that includes racism, sexism, transphobia, homophobia, classism, or elitism).

I’ll follow ouch and oops – if you say something that is or might be considered mean or aggravating, I will say ouch (and I’ll encourage others to do so as well). You’ll be encouraged to say oops and move on. If you’d like more education, more can be offered at a later time. If you recognize yourself saying something you’re not super proud of, say oops and move on.

Part of life is learning to be a better human. I learn something about this every day. There’s no reason learning can’t happen in this context.

We Know half the battle is knowing what’s coming

2026 Tax Season Preparedness Sessions

So we’ve put together a series of sessions designed to help you be as prepared as possible. Click these words to head directly to the signup form

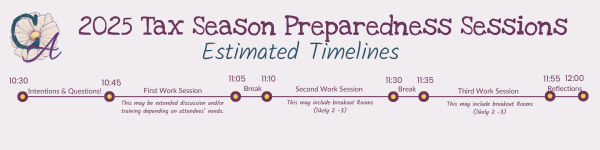

These sessions will happen bi-weekly on Tuesdays from 10:30PST to noon. You don’t have to come at the start, and you don’t have to stay for the whole thing.

Sessions are inspired by the concept of co-working: that you are and can be more productive when there’s someone else doing the same or a similar thing to you. It’s a tiny bit of accountability with celebrations and achievable expectations. Megan will be there to guide, assist, and facilitate. Your question or struggle may also be someone else’s. They may be able to tackle it because of your bravery. And vice-versa.

What are these sessions?

These sessions are loosely guided virtual meetings with as time set aside for you to do the things you need to do at and before year-end. There will likely be others in attendance. Attendance is limited to 10 people per session.

What will we do?

I have a loose plan in mind for each session. I’ll share that below, but, these plans may change based on attendee’s needs:

- Session 1: What information do businesses need to gather? What needs to happen before year-end?

- Session 2: Last-minute things to do before year end. Understand payroll bonuses, collections, purchases, and donations.

- Session 3: Repeat & mixed bag of sessions 1 & 2.

- Session 4: Payroll reporting, 1099s, personal property taxes, and other reporting that may need to happen in 2026.

- Session 5: Reconciling activity through year-end, reviewing Accounts Receivable and Payable, reviewing payroll results, dealing with things that didn’t get taken care of in 2024 but may should have been.

What's the cost?

One session is $147. You can buy a bundle of three sessions for $327. If you prefer the 1:1 session, these are $447.

Will I get to speak with you directly about my problem/issue?

Very likely, yes.

These sessions have been designed to allow for me to set up a break-out room in which we can discuss your specific need privately. You’ll also be able to share your screen so I can guide you to the right button to click and get the things done.

Breakout rooms are intended to be short, quick solutions.

I kind of like this format. Will you do more of it?

Yes!

This format is something I’ve wanted to offer for a while. I’ve tried a couple of times in the past and it’s not quite stuck. Fingers crossed this keeps working and the third time is a charm.

I don't like group activities.

Frankly, me neither! That’s the beauty of these: you’re not working together on a common goal. Your working on similar goals in community with each other.

And the signup form has an option for private, 1:1 sessions instead. These will be different than the group sessions.

What happens if I can't or don't make it?

I’m very busy/forgetful/virtual meetings like this are hard for me/I have social anxiety and may not be able to attend/what if an elephant walks through my door?

I understand life happens. I really do. I try to be as accommodating as possible. If there are sessions left, (i.e. it’s not the last session), I’d be happy to send you an invitation to another session.

As with any meeting, I’ll send a follow-up after the meeting to capture reminders and anything major discussed. These will be individualized for anyone who was in a breakout room with me.

The day or time doesn't work for me.

I’m very sorry Tuesdays at 10:30 PST aren’t a super great time for you. I’ll over you a few solutions:

- Send me your questions – Current clients can send me an email or ask a question in Acounta; new, onboarding, prospective, or otherwise non-clients can use the sign-up form or this Contact Us Form to get a conversation started);

- Come late or leave early! I won’t be offended. If you’re more than 15 minutes late, you may need to hang out in the virtual, “waiting room,” if I’m in a breakout session with someone.

- Have a private, 1:1 session (available through the Sign-up Form).

The fact of the matter is that there are no good times for things like this. I’d rather offer a solution of some sort than nothing at all.

What will you be doing during this co-working time?

Mostly, I’ll be making myself available to you.

I may click a few buttons of my own that I need to. I may color in a coloring book. I may knit or build or otherwise create something neat.

Unless I’m speaking or in a breakout room with someone, I’ll be muted and ready to help with questions you may have.

Do I have to do this?

You’re an adult. I can’t force you to do anything.

If you find yourself with questions about year-end, tax season, your tax return next year, and similar subjects, I encourage you to sign up for at least one session and attend.

I don't want to use the sign-up form. Can you just bill me?

I’ll need you to use the sign-up form at least once. That form is gathering information that’s helpful to me to help you. If you sign up for one session and decide you’d like to attend more/others, I can bill you instead of of you using the signup form for those subsequent sessions.

Who will be there?

You will be there. I will be there. Likely one or two or more others will be there as well. We’ll have a few minutes of introductions. No one will be forced to turn on their cameras, speak, or do anything they’re not comfortable with doing.

Is there a Code of Conduct?

Yes! The Code of Conduct is simply stated: don’t be a mean or aggravating person. If you’re nerdy like me, you can also consider Wheaton’s Law to be in effect.

A few more words: no isms. No actual isms or perceived isms (that includes racism, sexism, transphobia, homophobia, classism, or elitism).

I’ll follow ouch and oops – if you say something that is or might be considered mean or aggravating, I will say ouch (and I’ll encourage others to do so as well). You’ll be encouraged to say oops and move on. If you’d like more education, more can be offered at a later time. If you recognize yourself saying something you’re not super proud of, say oops and move on.

Part of life is learning to be a better human. I learn something about this every day. There’s no reason learning can’t happen in this context.

We Know half the battle is knowing what’s coming

2026 Tax Season Preparedness Sessions

So we’ve put together a series of sessions designed to help you be as prepared as possible. Click these words to head directly to the signup form

These sessions will happen bi-weekly on Tuesdays from 10:30PST to noon. You don’t have to come at the start, and you don’t have to stay for the whole thing.

Sessions are inspired by the concept of co-working: that you are and can be more productive when there’s someone else doing the same or a similar thing to you. It’s a tiny bit of accountability with celebrations and achievable expectations. Megan will be there to guide, assist, and facilitate. Your question or struggle may also be someone else’s. They may be able to tackle it because of your bravery. And vice-versa.